Social security online retirement estimator

Social Security is gradually raising the full retirement age the age at which your retirement and. Basic information to help you determine your gross income.

/GettyImages-184358375-81456f521f944c6a95f83dd84ce8b06e.jpg)

Social Security Benefits Definition

What Happens If You Want To Stop Social Security and Go Back To Work.

. You are over the income limit of 1630 by 370 each month. You can use the Social Security Administrations online benefit estimator to determine how much you will receive if you retire and start benefits at age 65. How the COLA Will Increase Benefits for the Average Senior Couple Another huge benefit to the online portal is the easy.

The Retirement Estimator is an interactive tool that allows the user to compare different retirement options. August 18 2022 By Stephen McGraw Director Division of Strategic Communications. If this is the case you may want to consider repositioning some of your other income to minimize how much of your Social Security Benefit may be taxed and.

Tier 1 railroad retirement benefits are the part of benefits that a railroad employee or beneficiary would have been entitled to receive under the social security system. You can also view retirement benefit estimates by. In 2021 she received a lump-sum payment of 6000 of which 2000 was for 2020 and 4000 was for 2021.

For most people full retirement age is either 66 or 67. The maximum amount of earnings subject to Social Security tax is 147000 in 2022. Primarily through a payroll tax.

The Retirement Estimator is limited to Social Security benefit estimates and does not capture other sources of retirement income. The Retirement Estimator calculator listed first in. Division O section 111 of PL.

The mySocialSecurity portal also shows estimates for retirement disability and survivor benefits you and your family may be eligible for. With your my Social Security account you can plan for your future by getting your personalized retirement benefit estimates at age 62 Full Retirement Age FRA and age 70. If youre self-employed you have to pay the entire amount.

The program will also be tweaked in several important ways. The government collects Social Security tax on wages up to 147000 in 2022. Did you know that up to 85 of your Social Security Benefits may be subject to income tax.

Social Security offers plenty of online calculators to help you estimate benefits andif you care to knowyour life expectancy too. The full retirement age for Social Security is 67 for everyone born in 1960 or later. Pick up where you left off.

Jane also received 5000 in social security benefits in 2021 so her total benefits in 2021 were 11000. 116-94 clarifies that employees described in section 414e3B which include ministers employees of a tax-exempt church-controlled organization including a nonqualified church-controlled organization and employees who are included in a church plan under certain circumstances after separation from the. Apply For Retirement Benefits Our online retirement application lets you apply for retirement in as little as 15 minutes.

How is Social Security funded. For a worker who becomes eligible for Social Security payments in 2022 the benefit amount is calculated by multiplying the first 1024 of average indexed monthly earnings by 90 the remaining. If you are beyond the 6-month protective filing date you should be able to start a new online retirement application.

The maximum benefit the most an individual retiree can get is 3345 a month for someone who files for Social Security in 2022 at full retirement age FRA the age at which you qualify for 100 percent of the benefit calculated from your. In 2020 she applied for social security disability benefits but was told she was ineligible. If you start your benefits at age 65 then your benefit amount will be reduced.

Earnings above the tax cap arent taxed by Social Security or used to calculate retirement benefits. This is the biggest Social Security cost-of-living adjustment in nearly 40 years. She appealed the decision and won.

The Social Security Administrations Retirement Estimator uses your actual Social Security earnings record to provide a benefit estimate for three claiming ages. My Social Security Retirement Estimate Get personalized retirement benefit estimates based on your actual earnings history. You can apply for Social Security online at ssagov by calling 1-800-772-1213 or in person at your local Social Security office.

Age 62 your full retirement age. Social Security payments will grow by 59 in 2022. Online Services Change Your Address and Phone Number Online with my Social Security.

For example suppose you are 65 years old receive 2500 in Social Security benefits every month and have a job that pays 2000 a month. Because the calculations are based on the individuals actual earnings record the user must enter more personal information such as Social Security number and mothers maiden name to access the benefit estimates. If social security benefits are received amounts from Box 5 on Form SSA-1099.

Your personal my Social Security account gives you secure access to information based on your earnings history and interactive tools tailored to you. Avoid mail delays and get your Form SSA-1099 or SSA-1042S Social Security Benefit Statement online at the Social Security Administration. If the only income you received during the tax year was your social security or equivalent railroad retirement benefits your benefits may not be taxable and you may not have to file a tax return.

You must be at least 61 years and nine months old to submit an. The current tax rate for Social Security is 62 percent for the employer and 62 percent for the employee 124 percent total. If you receive Social Security benefits the easiest way to change your address and phone number is by creating a personal my Social Security account.

For reference the average Social Security retirement benefit in May 2022 was 1668 a month. Please look for the general inquiry telephone number at the Social Security Office. If you are unable or prefer not to file online you can call us at 1-800-772-1213 TTY 1-800-325-0778 or your local Social Security office.

The Social Security Administration has an online calculator that will provide immediate and personalized benefit estimates to help you plan for retirement. How much will Social Security pay me at 65. Return To A Saved Application Already started an application.

If a person files at age 70 if they had a full retirement age of 66 that means they waited 48 months beyond full retirement age so they would get 132 of their primary insurance amount Piper.

Estimate Your Benefits Arizona State Retirement System

Social Security Sers

Retirement Estimator Investor Gov

How Much Your Social Security Benefits Will Be If You Make 30 000 35 000 Or 40 000 Youtube

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

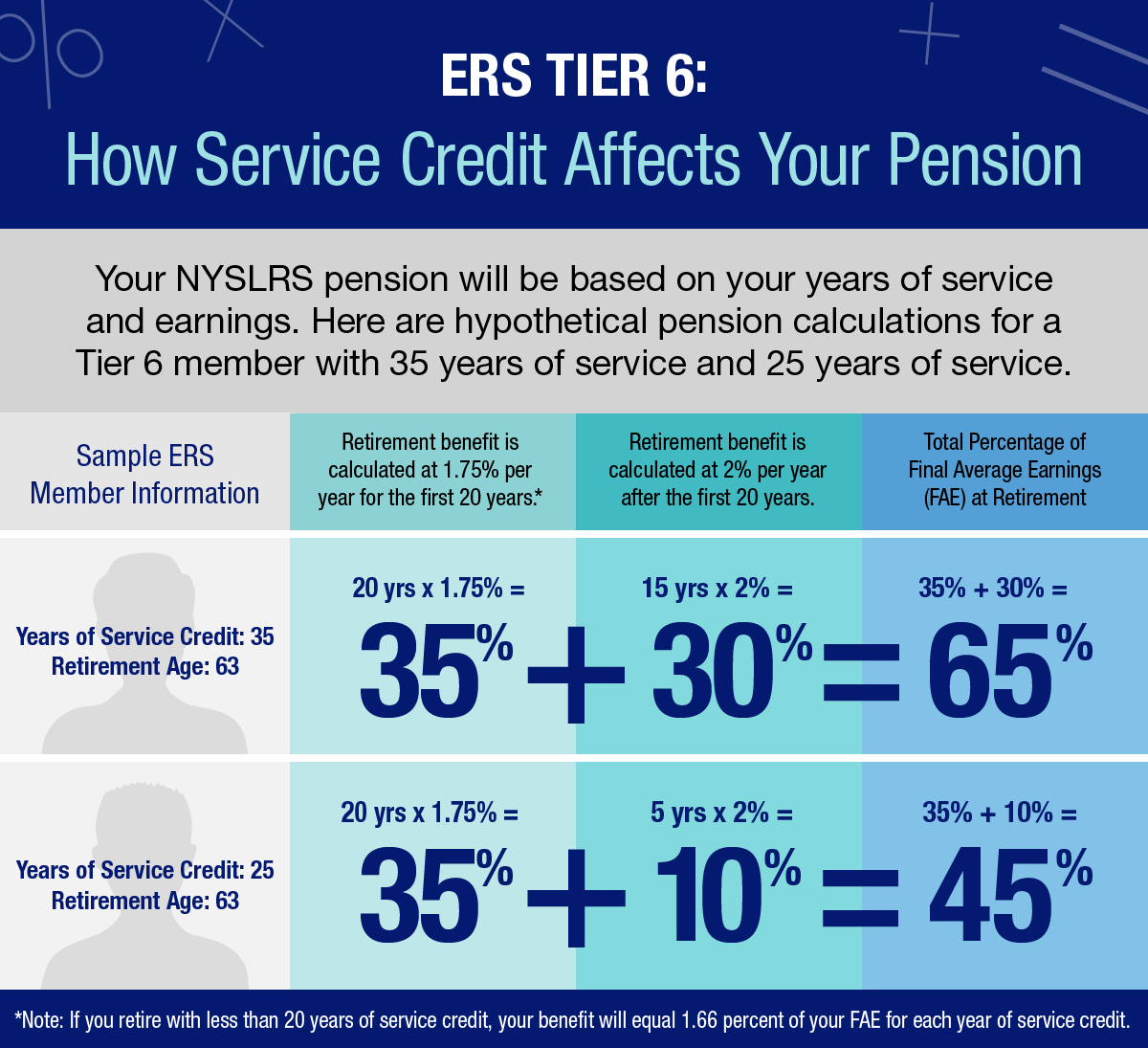

Ers Tier 6 Benefits A Closer Look New York Retirement News

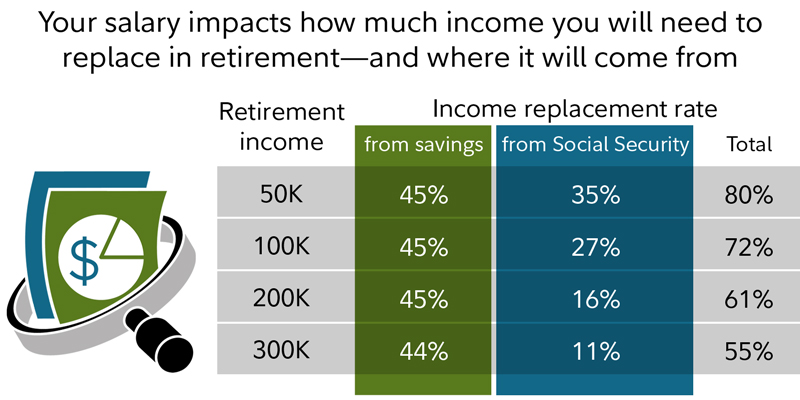

What Will My Savings Cover In Retirement Fidelity

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

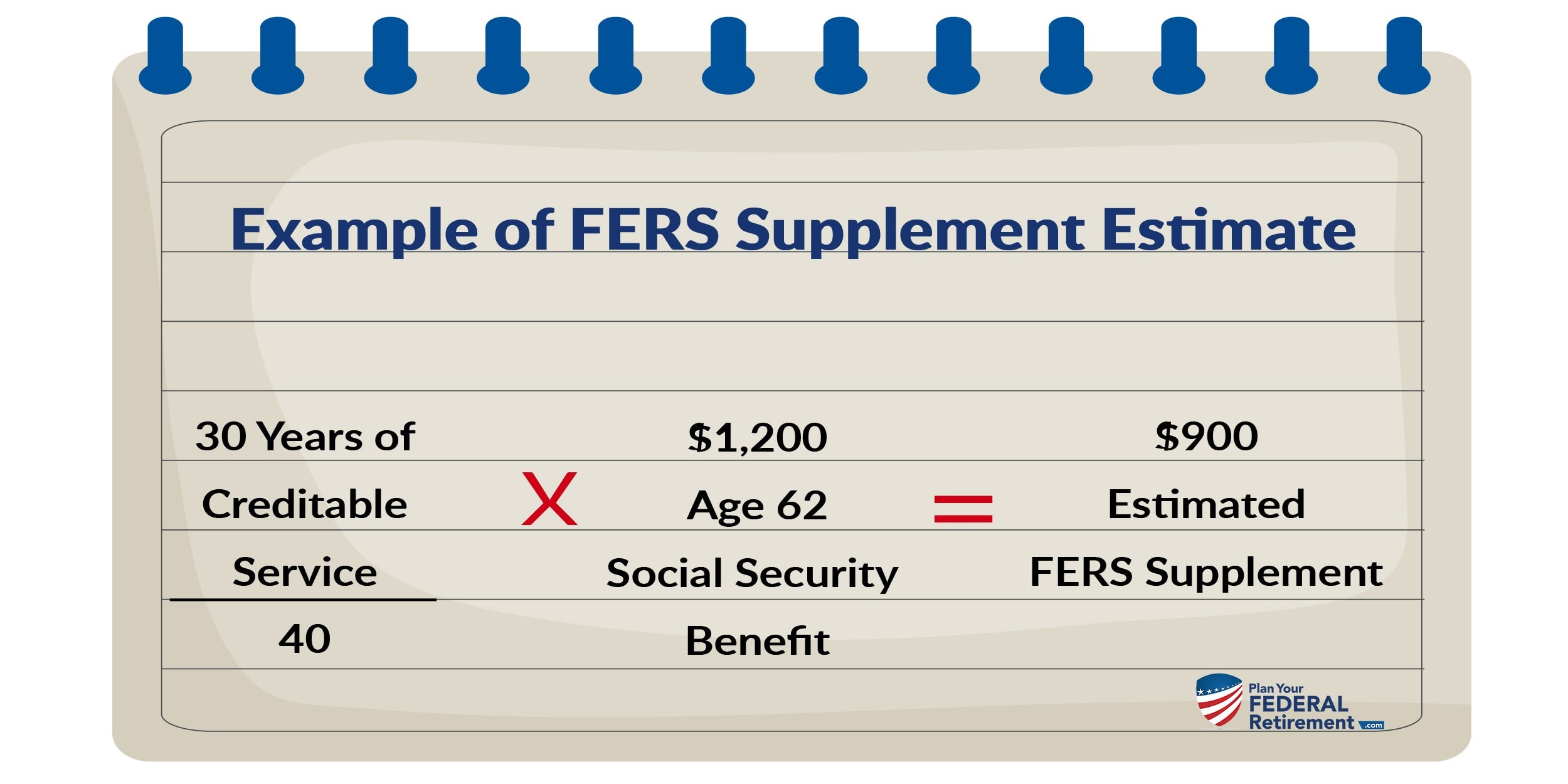

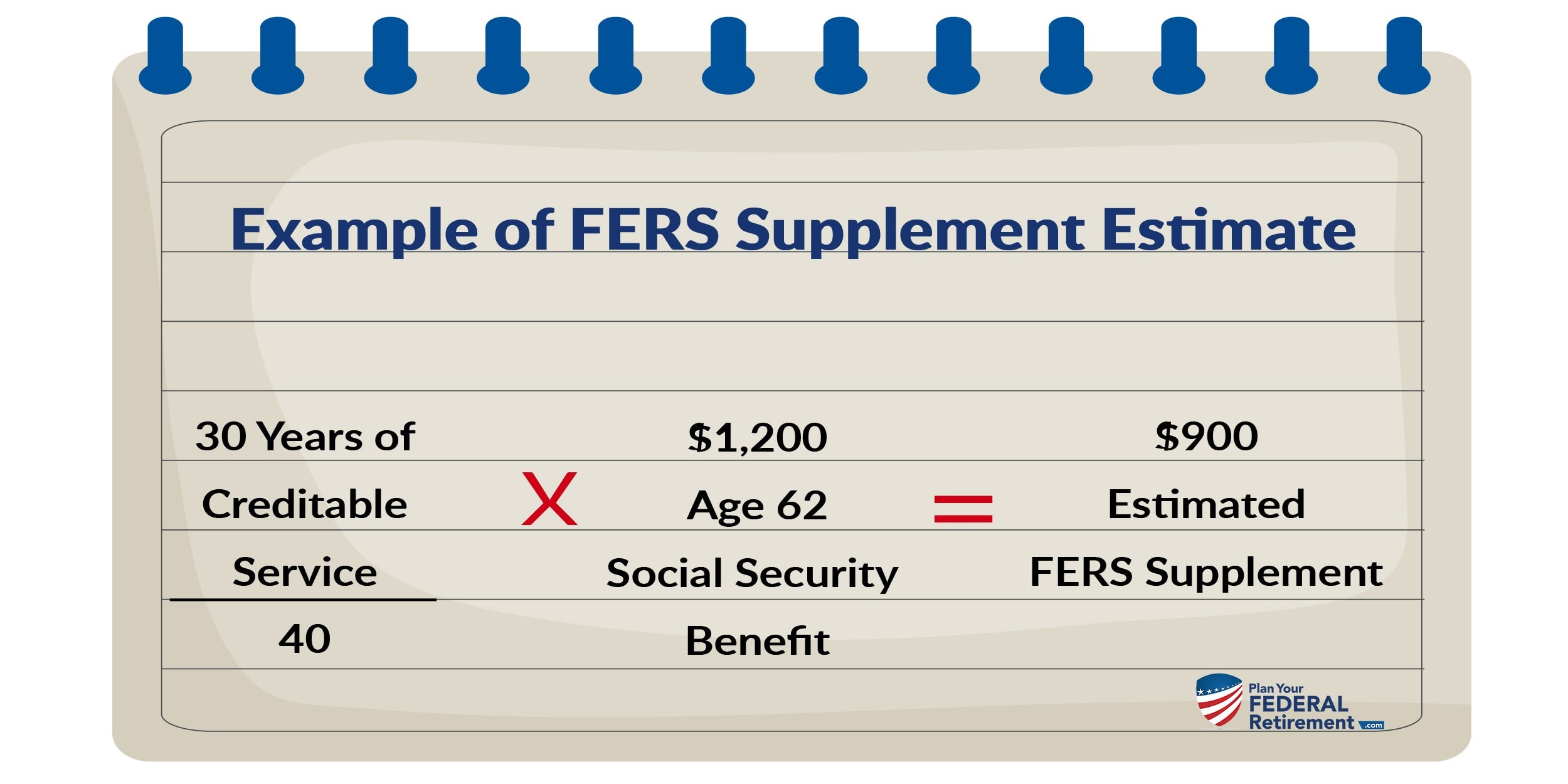

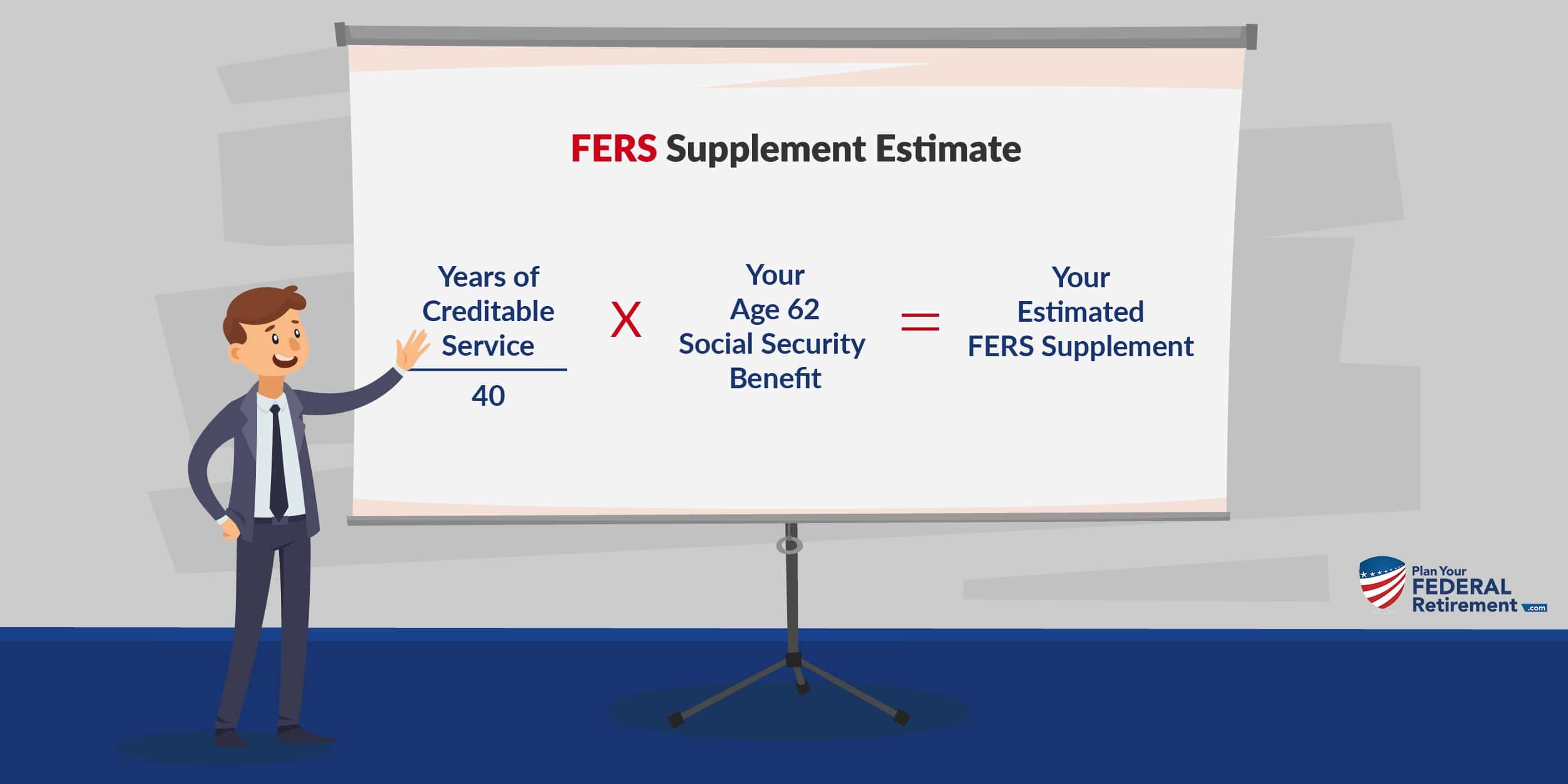

Fers Supplement Plan Your Federal Retirement

Service Disability Retirement Calpers

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Spousal_Benefits_Calculated_for_Social_Security_May_2020-01-29ec05cc8e7241ec95054d75a3d998aa.jpg)

How To Maximize Social Security Spousal Benefits

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

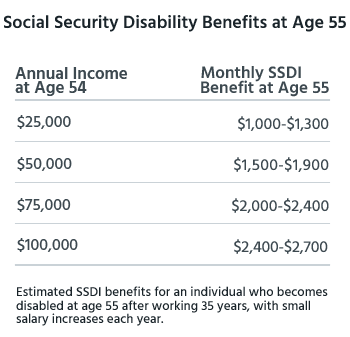

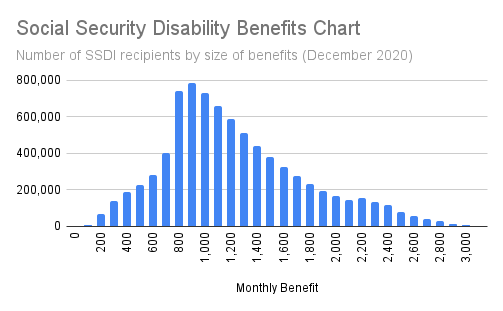

How Much Can You Get In Social Security Disability Benefits Disabilitysecrets

Information For Financial Planners Ssa

How Much Can You Get In Social Security Disability Benefits Disabilitysecrets

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

Fers Supplement Plan Your Federal Retirement